How OEM Telematics Is Powering the Next Generation of Fleet Data

At the Fleet Forward 2025 conference in San Diego this October, leaders from Ford Pro, Stellantis/Mobilisights, Enterprise Fleet Management, and Motorq discussed one of the most significant transitions in fleet management: the shift from aftermarket telematics hardware to factory-installed, embedded connectivity.

The session, Factory-Installed vs. Aftermarket: Choosing the Right Telematics Path & Managing the Data, examined how automakers are reshaping the telematics landscape and what fleets should consider as they evaluate their next technology strategy. Moderated by Arun Rajagopalan, CEO of Motorq, the panel explored adoption trends, data quality, operational implications, and the growing collaboration between Original Equipment Manufacturers (OEMs), technology providers, and fleet operators.

Fleet Forward 2025 OEM telematics panel

OEM Telematics is Becoming the Fleet Standard

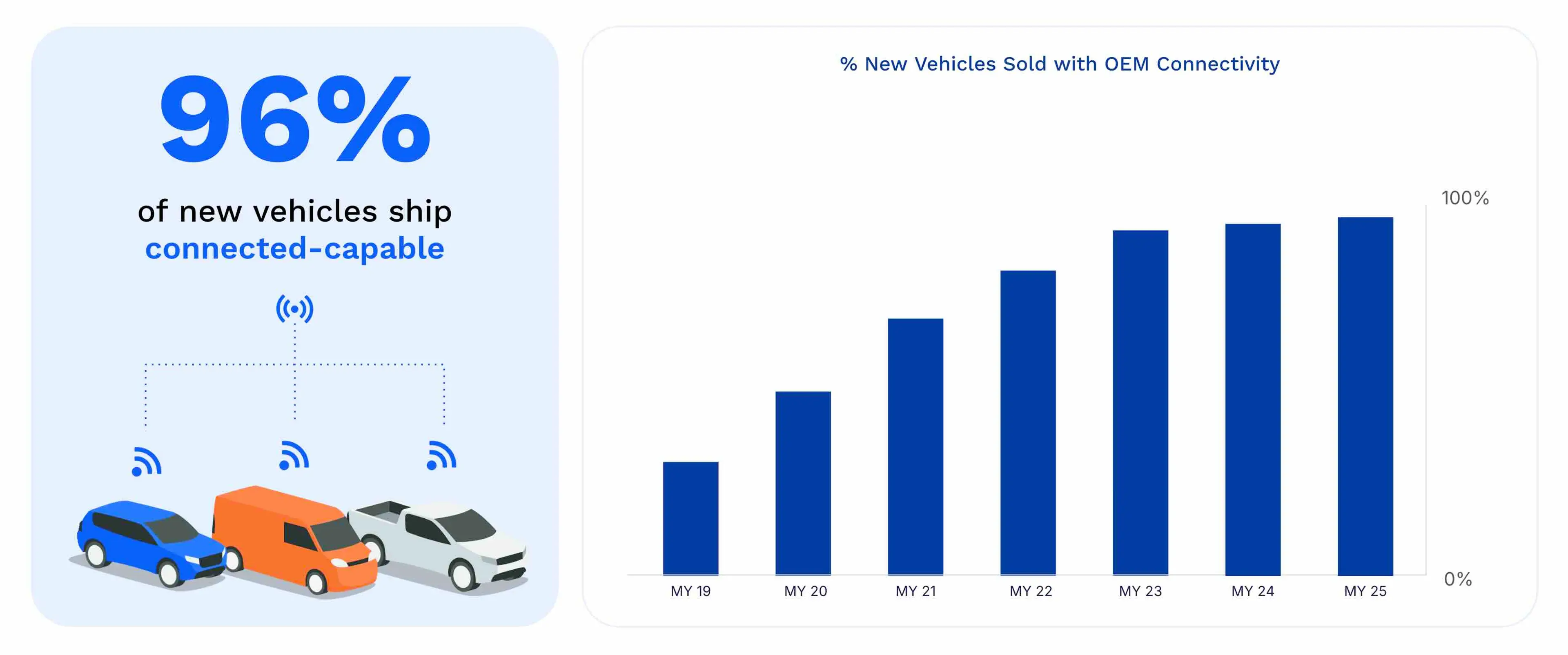

Embedded connectivity has become nearly universal. 96% of new vehicles sold today include factory-installed modems capable of transmitting operational data directly from the vehicle. Connectivity remains high even with older vehicles, with roughly 85% of three-year-old lease returns connectable.

“Connectivity has followed the same path as safety features like seatbelts or airbags. They were once optional, but now they’re standard,” Rajagopalan remarked. That standardization is transforming fleet operations. Factory-installed systems eliminate the logistical and financial challenges of aftermarket installations, reduce tampering or theft risks, and provide more consistent access to verified vehicle data.

Chart showing percentage of new vehicles equipped with OEM connectivity

Factory-Installed Connectivity Reduces Cost and Offers Unmatched Scale

Panelists agreed that aftermarket hardware still plays a role in certain programs, but it largely depends on the data needed. As Billy Dobosz, AVP of Business Development at Enterprise Fleet Management explained, “Many fleets primarily want access to accurate odometer readings, oil-life data, and battery health. It’s information that embedded systems already deliver efficiently.”

Aditya (Eddie) Nath, Head of North America Sales at Mobilisights, the DaaS business unit of Stellantis, illustrated the difference in scale: “We activated 50,000 vehicles in two days. Doing that with aftermarket hardware would have taken months.” For most fleets, OEM telematics now provides a faster, cleaner, and more reliable foundation for data-driven operations.

We activated 50,000 vehicles in two days. Doing that with aftermarket hardware would have taken months.

The panel also noted that the operational friction of hardware installation remains a significant drawback. Device shipments, scheduling installers, and managing inventory all add time and expense. “No one enjoys dealing with plug-in devices,” Aaron Osborne, TSP Partner Manager at Ford Pro, added. “They served their purpose, but the industry has evolved.”

OEM Connectivity Meets or Exceeds Hardware Performance

Concerns about the reliability and latency of OEM telematics were common in earlier years, but panelists said those perceptions are changing rapidly. OEMs have invested heavily in the engineering and cloud infrastructure behind connected systems, resulting in stronger signal integrity and faster data delivery.

Modern OEM systems now transmit data to the cloud in less than 30 seconds, a speed that meets the needs of almost all fleet operations. Osborne noted that, in practice, this latency feels no different from what fleets once experienced with plug-in hardware.

Another key advantage lies in data authenticity. “We’re pulling signals directly from the vehicle’s real sensors, not a secondary source,” said Nath. “That means more reliable readings and fewer inconsistencies.”

Osborne added that embedded systems now support advanced functions such as remote lock and unlock or engine start and stop — features impossible with plug-in hardware. The consensus was clear: OEM telematics has reached a level of reliability that rivals or exceeds legacy hardware-based systems. While a few edge cases like accident reconstruction still benefit from external devices today, OEMs are closing that gap fast through richer data sets and evolving in-vehicle architectures.

Collaboration is Fueling the Next Phase of Telematics

Collaboration across the ecosystem is key to realizing the value of OEM data. Automakers are investing heavily in software organizations and APIs to support broader data integration. Mobilisights has created a dedicated software and data division within Stellantis, while Ford Pro stood up software development in-house offering comprehensive solutions tied to the vehicles themselves and continue to expand direct integration programs for telematics service providers (TSPs).

As Rajagopalan observed during the session, “No single entity, whether OEM, fleet, or technology provider can solve this alone. The real opportunity comes from collaboration.”

One of Motorq’s primary roles, the panel noted, is to act as an integrator, unifying data streams from multiple automakers into a single, normalized view. This approach allows fleets to maintain flexibility in their vendor relationships without the need for a rip-and-replace migration. “Adopting OEM connectivity means fleets can choose the vendor that gives them the best service,” Osborne said. “They’re no longer locked in by hardware.”

Adopting OEM connectivity means fleets can choose the vendor that gives them the best service. They’re no longer locked in by hardware.

Expanding into a Full Lifecycle View

Looking ahead, panelists agreed that the next phase of OEM telematics will focus on richer datasets, new applications, and continued privacy and compliance leadership. OEMs are designing their systems to align with data protection laws such as CCPA and GDPR, incorporating consent-by-design frameworks that ensure transparency for drivers and fleet operators, and achieving ISO 27001 certification to ensure secure data management.

The discussion also touched on emerging use cases: predictive maintenance, EV battery health monitoring, charging behavior analysis, and lifecycle planning from factory to resale. As Rajagopalan summarized, “Embedded connectivity is unlocking a full vehicle lifecycle view from production line to end-of-life. And that visibility changes how fleets plan, operate, and remarket assets.”

Where Fleet Connectivity Goes Next

The panel’s discussion underscored a clear industry shift. OEM telematics is no longer a secondary data source or an emerging trend — it’s the new baseline for modern fleet management. The pace of adoption, combined with rapid improvements in reliability and integration, signals a turning point for how fleets collect and use vehicle data.

By aligning automakers, technology partners, and fleet operators around shared data standards, the industry is creating a more connected, efficient, and software-driven ecosystem. OEM telematics has moved from innovation to infrastructure, and its impact on fleet performance is only beginning to unfold.